Demonetisation in numbers—how statistics were used

The hastily implemented decision to demonetise high-value currency notes on November 08, 2016 is believed to have helped the BJP to sweep the 2017 Uttar Pradesh assembly elections. A year later the country is gradually recovering from the economic shock and debating the long-term implications of the move. This piece examines the commentary that appeared around the first anniversary from a statistical perspective.

“News”

Several news items used statistics in headlines. CBI detects 396cr in slush funds in 1 year (Times of India, Nov 9) is a typical anniversary news item built around decontextualised statistical measures. It used an absolute figure in the headline. The impact of this news item would have been quite different had it used the share of the total slush funds in the economy that the CBI was able to detect. It would have also helped if the text of the news item mentioned the amounts detected by the CBI in the years preceding demonetisation.

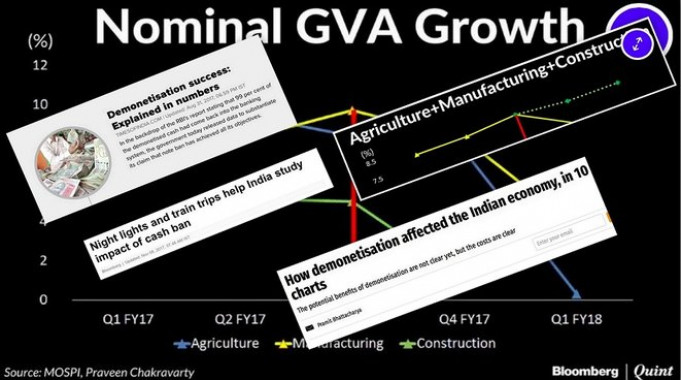

Demonetisation: Ten figures that underline impact of PM Modi’s note ban (Indian Express, Aug 31) is a good example of infogram-driven news items. It contains an infogram – Demonetisation in numbers – that suggests among other things that the GDP declined by 2 per cent due to demonetisation. However, that need not be true as a variety of factors govern GDP. Using alternative methods of monitoring economic activity, Night lights and train trips help India study impact of cash ban (Economic Times, Nov 8; also Livemint, Nov 9) points out that the drop in GDP growth rate cannot be directly attributed to note ban and that the economy is rebounding to the pre-demonetisation level.

In fact, the text of the above Indian Express item itself notes that “After the country’s GDP growth fell close to two per cent, this year’s midterm economic survey had indicated that the impact from demonetisation is between 1/4 and 1/2 percentage points relative to the baseline of about 7 per cent.” So, the text and infogram of the news item do not seem to agree with each other. Elsewhere, analysts have suggested that “analysing the impact of demonetisation using headline GDP numbers is too simplistic and misleading” (Praveen Chakravarty, Demonetisation’s Economic Impact: $15 Billion On 3 Vital Sectors, Bloomberg Quint, Nov 8). Also, there is an element of redundancy in the Express infogram as three out of the ten statistics it reports effectively convey the same thing.

In contrast Demonetisation success: Explained in numbers (TOI, Aug 31) focused entirely on the positive aspects. “Unprecedented increase in Tax Compliance” is one of the headings in this infogram-centric news item. The word unprecedented requires examination of the growth in tax base over the entire relevant period, at least, stretching back to the early 1990s when the economy was liberalised. However, evidence supporting this unprecedented development stretches back to one year before demonetisation! Another heading “India’s highest ever detection of black money” is not supported by any comparison, whereas the word highest requires comparison among at least three years. (Interestingly, the two headings of this TOI item of Aug 31 mentioned here are almost identical to the headings in the full page advertisement of the government published on Nov 8.)

The flippant use of adjectives coupled with decontextualised statistics create an illusion of success. Another key point in this news item reads: “Black money worth Rs 16,000 crore did not return post demonetisation.” However, it is not clear why that amount should be labeled black money even before the relevant government agencies have officially identified it as such. The news item did not ask if Rs 16,000 crore might be accounted for by the nearly Rs 8,000 crore of the old currency still with cooperative banks and the old currency held in neighbouring countries, particularly, Nepal.

The differences between the coverage of demonetisation in Indian Express and Times of India on August 31 are revealing. Indian Express noted a “Rs 899,700 crore decline in currency circulation,” whereas the Times of India item highlighted “21 per cent reduction in currency in circulation.” The format in which numbers are reported is not innocuous. Newspapers make choices in this regard for reasons best known to them. More generally, Indian Express focused on the withdrawal of notes, while Times of India presented information on the multidimensional character of demonetisation and both its direct as well as indirect benefits.

“Short-term” pain

Demonetisation and the fight against black money (Satish Deodhar, LiveMint, Nov 8, Opinion) that repeats statistical claims and arguments put forward by the government is typical of partisan commentary. It begins by noting that demonetisation “caused, expectedly, inconvenience to public for a certain period of time” (emphases added). What is particularly striking about this article, and other such articles, is the invocation of decontextualised GDP growth statistics: “what about the decline in GDP growth rate to a tad below 6%? Of course, it was anticipated that the double-exogenous shock of demonetisation and transition to GST would cause short-run disturbance in economic activity. However, even today, India is one of the fastest growing economies, where the 2017 average expected GDP growth rates for advanced countries and emerging markets are only about 1.9% and 4.1%, respectively” (emphases added).

Here GDP growth rates are compared mechanically without explaining the context for the relatively lower growth rates of advanced countries, which already enjoy very high per capita incomes. The article assumes that demonetisation was necessary and justifies the timing by claiming that “the only time a demonetisation can be carried out is when GDP growth rate is high enough to absorb a temporary shock. It would have been unwise otherwise.” He concludes by arguing that it is too early to measure the overall impact of demonetisation. In passing note that the article assumes that the entire 16,000 crores not returned to the RBI is black money.

More Angels Than Demons (Sanjaya Baru, TOI, Nov 7) explained the immediate/transient effect of demonetisation through a comparison with liberalisation: “The reduction in fiscal deficit and tariffs in 1991-92, as part of an economic reform and stabilisation programme, had the initial impact of sharply bringing down the real GDP growth rate from 6.89% in 1989-90 and 5.37% in 1990-91 to a paltry 0.8% in 1991-92. The initial deceleration in growth was met with sharp criticism both from within the ranks of the political opposition as well as from within the ruling Congress party. However, a year later, the growth rate picked up and the short-term disruption imposed by fiscal stabilisation and trade reform initiatives gave way to long-term gains for the economy as a whole.” (Emphasis mine). It is not clear why the economic impact of demonetisation should unfold in the manner of the impact of budget deficit control two and a half decades ago. He adds: “One did not require rocket science to have predicted that the withdrawal… would have a huge disruptive impact... Truth be told, it is still too early to come to a final conclusion on this issue.” This is followed by a spirited defence of the government’s “policy activism” and approval of its attempt "to create a new political discourse around economic reform and engage the civil society in that process."

Why Sequencing Matters (Raghbendra Jha, TOI, Nov 7) boldly argues that demonetisation “was essential to sharply reduce the size of India’s informal economy to make GST a success. By this logic, demonetisation should have occurred before the implementation of VAT in 2005.” And, it calls for emulation of Denmark: “some governments (eg Denmark), routinely discourage the use of currency notes.” Denmark does several other things too, why just stop at blindly copying its purported penchant for cashlessness? Even a cursory familiarity with Denmark’s size, literacy rate, structure of economy, internet and banking services penetration, and the strength of its state institutions would suggest that the comparison is pointless. The article begins with a definitive claim that GST and demonetisation have “drastically reduced the size of the informal economy in India” without giving any evidence and concludes that “Although their implementation caused temporary hardships to many, faster, more transparent and inclusive economic growth lasting well into the future is now imminent” (emphases added).

Four clear benefits that prove demonetisation is a success (Soumya Kanti Ghosh, Hindustan Times, Nov 8) claims that “some short-term pains are inevitable. Interestingly, the experience of OECD and European countries shows that the actual benefits on growth, unemployment and consumption of such long-term measures begin to manifest after two years. In essence, there could be some postponement of immediate consumption leading to negative impact in the short term.” Such decontextualised comparisons are misleading given the deep structural differences between India and Europe. In addition, the article does not refer to concrete evidence in support of its claim regarding the European experience. Interestingly, unlike the rest of the partisan commentary that vaguely refers to the long-run benefits, this article suggests that the benefits will “begin to manifest after two years,” i.e., we should wait until after the 2019 elections! The article abounds in statistical claims, one of which stands out for its naiveté: “the trend in total number of actions taken by the central vigilance commissions suggests that during the last two years, the number of outside complaints received by CVC is significantly declining reflecting the public faith in cleaner administration now.”

Two aspects of partisan commentary stand out. First, the use of decontextualised comparisons. Not coincidentally, similar (international) comparisons influenced the decision to demonetise. Second, favourable “facts” are mentioned in numbers, while the inconvenient ones are expressed in words that attenuate the negative aspect: short-run disturbance, short-term disruption, short-term pains, temporary hardships, imminent, tad below, drastically reduced, inconvenience for a certain period of time, etc. As Revolution that wasn’t (Pratap Bhanu Mehta, Indian Express, Nov 8) puts it “when utopia did not arrive, the revolution changed the goal post, presenting modest statistical trends as success.”

Behavioural shift

Full page government advertisements on November 8 claimed among many other things that demonetisation induced a “behavioural shift” in favour of cashless economy (Economic Times, Nov 8). Top bankers made similar claims (Demonetisation expedited digitisation, say bankers, Financial Express, Nov 6). How was the statistical evidence on the extent of behavioural shift reported and analysed?

Demonetisation and the move to a less-cash economy (Nandan Nilekani, Livemint, Nov 8) noted that “While 8 November 2016 is etched in our collective memories as the day we switched to cashless, it was just the start. Digitization was always going to be a long process, and we still have a way to go. But, demonetisation was definitely the defining moment in India’s journey to a less-cash economy.” It explained how demonetisation triggered a digital payments revolution insofar as both the infrastructure (PoS machines) and transactions recorded growths that dwarfed what was achieved in the whole of the last two decades. The article cited data about the number of transactions and total value of transactions. However, it overlooked the fact that the number of transactions through UPI-BHIM grew by almost 750 times post-demonetisation, but the average value per transaction dropped from about Rs 4900 to Rs 920. Other partisan commentary also overlooked this fact. The article also did not look at the growth in transactions disaggregated across months, which might have been very high in the immediate aftermath and could have plateaued out later on.

Behavioural shifts are better measured over a few years. However, since the author is comfortable basing judgements on just one year’s data, one could ask if the data, in fact, suggest that the cash-to-GDP ratio will not decline as fast as the spectacular growth of PoS machines. So, the movement toward a less-cash economy (in terms of overall value of transactions) might be much slower rate than claimed/expected. Was this change not going to be achieved anyway with the growing reach of internet and app-economy and growing urbanisation and literacy? The article overlooks the mutually constitutive relation between digital transactions and other elements of the socio-economy. The map of the extent of digitisation of transactions in different states accompanying Cash still king as digital payments inch up slowly (TOI, Nov 8) suggests that there is some correlation between the use of digital payment modes and literacy rates, urbanisation rates, share of formal sector in the economy, and per capita incomes.

There is ample evidence that the ongoing shift has been much slower than claimed. Post Note Ban, Most Retailers Ready to Accept Cashless Payments, Finds CDFI-IIMB Survey (Economic Times, Nov 8) notes that while 63% retailers wanted to go cashless, compared to 31% before note ban, this willingness did not reflect in actual transactions as only 11% of which were cashless. Several infograms published in different newspapers, e.g., One year after note ban, cash is still king (LiveMint, Nov 8), show that demonetisation does not seem to have induced a lasting behavioural change, as people went back to cash as the economy was remonetised. In How I Managed Demonetisation (R. Gandhi, Economic Times, Nov 8), a former RBI officials admits that: “Yet another blow to our plans was the public behaviour (or should I say non-behaviour) relating to digital payments. We had factored that once people had deposited their old cash into bank accounts and with the limits/restrictions on withdrawal of cash, the availability of digital means would lead to more transactions through RTGS, NEFT, internet and mobile banking facilities. Unfortunately, and to our dismay, this expectation had not been fulfilled.” What was the opportunity cost (to the weaker sections) of resort to demonetisation to promote, what at present seems to be, a minor acceleration in the pace of digitisation of the economy?

Did note ban induce firms to adopt digital payment? (Bornali Bhandari, Ajaya K Sahu and Mridula Duggal, Business Standard, Nov 9) stands out with regard to the assessment of the impact of demonetisation on digital payments. It examines the shift to digital modes of payment using the NCAER’s Business Expectation Survey (BES) conducted in March 2017 that covered “more than 500 [organised sector] companies in six metropolitan cities.” Firms in the BES sample are more likely to be better equipped than individuals and informal and non-urban firms, to transact digitally. The article suggests that demonetisation was successful in nudging BES firms toward digital modes, but adds that further surveys post-full remonetisation are required to establish if the shift was stable.

Unlike most of the analyses and news items, Less cash, but slowing digitisation (A.K. Bhattacharya, Business Standard, Nov 8) pays close attention to the estimation of the cash in circulation that is central to the polemical debate on demonetisation. The article compares the latest estimates of cash in circulation with projected estimates of the same and comes to the conclusion that India is operating on at least 20 per cent less cash than before (also see Surjit Bhalla’s Demonetisation and its contents, Indian Express, Nov 8).

The road not taken

Most observers broadly agree with the end goal of formalisation, but question the timing and manner of implementation, i.e., the costs of demonetisation and the disproportionate share of the poor in the costs (e.g., Pratap Bhanu Mehta, Revolution that wasn’t, Indian Express, Nov 8 and Ashima Goyal, DeMon, at what cost? Hindu BusinessLine, Nov 8). They also note that demonetisation has not been entirely devoid of positives (A mixed bag, Hindu BusinessLine, Nov 8 and The demonetisation puzzle, Business Standard, Nov 7). However, some of the deeper issues were left unattended in the larger debate.

We did not ask how a democratically elected government can decide on its own, without parliamentary deliberations, that the behaviour of the people who voted it to power is unacceptable and, hence, fit to be changed. To be fair to the government, it had over time given ample clues that it wants to discourage particular modes of payment.

The irrational fear of informal, unregulated spaces did not attract sufficient attention partly as our intellectual training has privileged the formal sector because it is purportedly modern, transparent, efficient, and free of traditional tyrannies, among other things. In Revolution that wasn’t Pratap Bhanu Mehta noted that “Formalisation was a desirable objective of demonetisation. But it underestimated the fact that informality was also a form of low-cost participation. Formalisation without preparation leads to exclusion.” The Businessline editorial A mixed bag questioned the “criminalisation of the entire cash economy” and “the assertion that the reduction in cash to GDP ratio is an unqualified good.”

There was hardly any reflection on what the increasing reliance on statistics to communicate and assess public policy means for our democracy. There is a realisation that politics and statistics interact, but the implications of mutually constitutive nature of the two are not fully appreciated. Several questions that ought to be asked were either not asked, asked in isolation, or asked only in passing: what are the normative and intellectual foundations of a policy; is the impact of the policy measureable; when is the right time to measure the impact; what are the means of measurement available, how accurate are they and how do they interact with theoretical frameworks used to assess the impact of policy; how are measurement choices influenced by political processes, etc. Equally importantly, hardly anyone asked how we should analytically disaggregate the effects of global economic turmoil, demonetisation, uncertainty of GST, etc to better understand the immediate and long run impacts of demonetisation. In passing note that the discussions freely used GDP statistics to gauge the impact of demonetisation ignoring the doubts all of us had until recently about the quality of GDP estimates.

Our newspapers seem to lack in-house analytical capacity, which reflects in the fact that even one year later they have not gone beyond rudimentary analysis (actually, graphical presentation) of government data. The otherwise bitterly polemical Demonetisation and its contents (Surjit Bhalla, Indian Express, Nov 8) is among the few exceptions insofar as it tried to deal with critiques of demonetisation through detailed (as far as allowed by the op-ed format) statistical comparisons. (Digital editions of newspapers should be used to present further analysis of terse claims in the print edition.) Similarly, Why Sequencing Matters (Raghbendra Jha, TOI, Nov 7) went a step beyond the standard defence of timing of demonetisation and tried to build a case based on our experience with the introduction of VAT. Demonetisation’s Economic Impact: $15 Billion On 3 Vital Sectors (Praveen Chakravarty, Bloomberg Quint, Nov 8) is another example of focused analysis that tried to lay bare its assumptions to enable a reasonable critique and also make it easy for lay readers to follow the argument.

To conclude, the coverage of the anniversary of demonetisation was an assortment of stories from Bharat, coverage of political mudslinging, infograms based on government data, and some invited commentary. From the statistical perspective, the coverage was not quite insightful and nuanced and reminds of the clumsy coverage of the release of the 2011 Census data on religion. It is not my case that the newspapers blindly used statistics, though. In fact, they made crucial choices, including what to highlight. Recall, for instance, the sharp contrast between the coverage of demonetisation in Indian Express and Times of India on Aug 31, 2017. Newspapers also chose whether to use absolutes figures or percentages to convey information and they also chose adjectives for describing statistics.

A more analytically careful public debate is called for if it has to serve as a useful guide to voters ahead of the 2019 elections that will see the use of statistics in campaigns on a much larger scale than in the 2014 elections.

Vikas Kumar teaches Economics at Azim Premji University, Bengaluru.